The construction industry continues to face challenges as it experiences a decline in output for the third consecutive month. This downward trend has been primarily attributed to the simultaneous increase in prices and shortages of materials. Recent government data indicates that the rebound the industry experienced in the aftermath of the pandemic has lost its momentum, mainly due to decreases in repair and maintenance activities as well as new projects in the private housing sector.

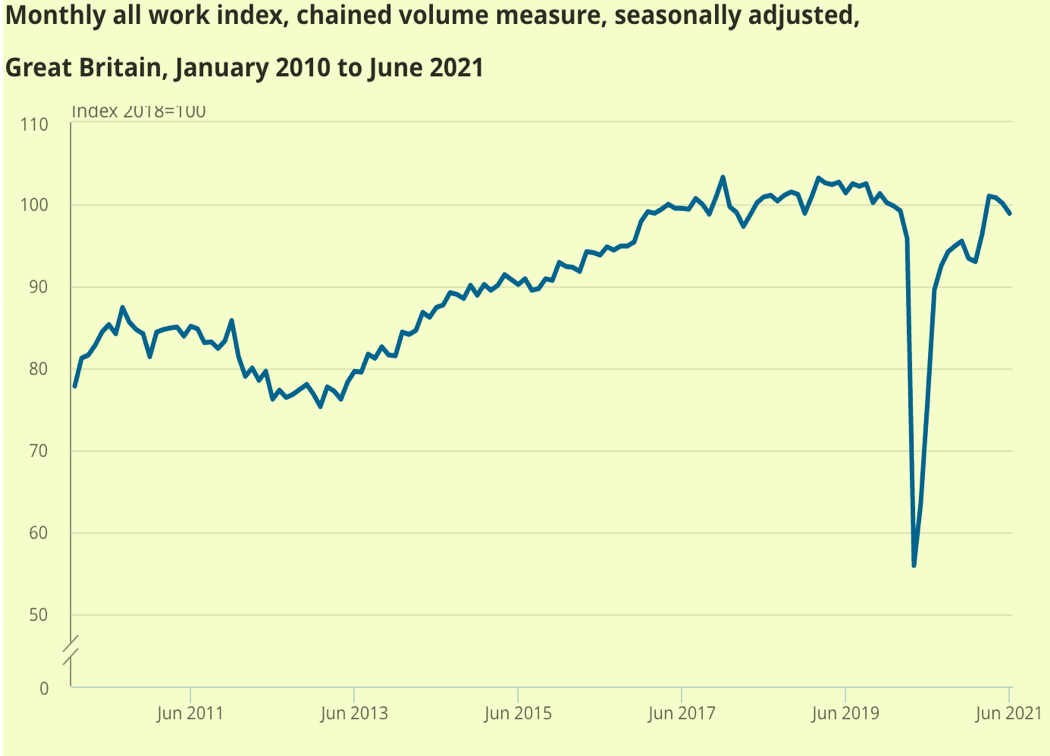

In the month of June, the monthly construction output witnessed a decrease of 1.3%. This decline was primarily driven by a substantial drop of 4.2% in repair and maintenance projects, although it was partially offset by a modest increase of 0.5% in new construction work. The overall industry output fell below the pre-pandemic peak that was recorded in February. Despite these consecutive monthly declines from April to June, the second quarter as a whole still managed to exhibit growth that was 3.3% higher than the first quarter. This positive growth can largely be attributed to the steady expansion of infrastructure projects during this period.

The annual rate of construction output price growth reached an impressive 3.4% in June, marking the strongest annual growth rate seen in almost two years. Fraser Johns, the finance director at Beard, expressed concern over this continuous decline in output. He emphasised that the industry is being significantly impacted by material shortages, rising prices, labour scarcity, and insufficient transportation capacity to supply building sites. However, Johns also acknowledged the encouraging growth experienced in the second quarter, which was driven in part by new orders. Nevertheless, the growth rate in the construction industry still falls behind the overall economic growth rate of 4.8%. Johns stressed the importance of collaboration among various stakeholders within the industry to effectively address these challenges and manage the ongoing decline.

Mark Markey, the managing director at Akela Group, a civils contractor based in Scotland, also recognised the disappointment stemming from the decrease in monthly output. Markey highlighted the difficulties faced by the sector in terms of material supply and rising costs. He emphasised the need for adapting procurement processes to ensure the timely availability of necessary materials on-site, thereby mitigating the impact of these challenges.

Materials shortages have affected a wide range of sectors within the construction industry, including timber, steel, cement, and tiles. However, infrastructure, industrial, and public housing new work seem to be less affected by these shortages. The limited availability of materials has undeniably had a significant impact on construction activities. Nonetheless, there is a brighter outlook based on the levels of new orders received, provided that projects are not constrained by labour and material shortages. In the second quarter, the total number of new construction orders experienced an impressive growth rate of 18% compared to the first quarter. Notably, private commercial office orders witnessed a significant surge of 48%, likely attributed to the return of workers to office spaces. The growth in infrastructure projects reached 25%, driven by orders for road and rail development. New housing orders displayed more moderate growth, with private housing experiencing an increase of nearly 5% while public housing orders declined by 15%.